4.8 / 5.0 on Google Reviews

Master Accurate Accounting, No Hard Work Required

Empowering you to conquer accounting and tax compliances, saving time and reducing errors

Eliminate Paperwork Hassles With Grof's Outsourced Accounting and Bookkeeping Services In Singapore

Our dedicated team of financial professionals is readily available to assist you. Liberate your business with our all-in-one outsourced accounting services in Singapore, including bookkeeping, payroll, and tax compliance. We also specialise in helping businesses with GST registration and filing in Singapore, including determining eligibility, preparing necessary documents, and completing the registration process for you. In addition to our core services, we offer other corporate solutions , including company secretary and company incorporation services in Singapore .

Annual Tax

Return Filing ensure compliance and peace of mind with our expert tax filing services in Singapore.

Bookkeeping

Efficiently manage your finances with our detailed monthly or annual bookkeeping services.

Financial Reports

Receive concise financial reports monthly or annually to enhance your business decision-making.

Payroll

Streamline your payroll management to save time and minimise errors.

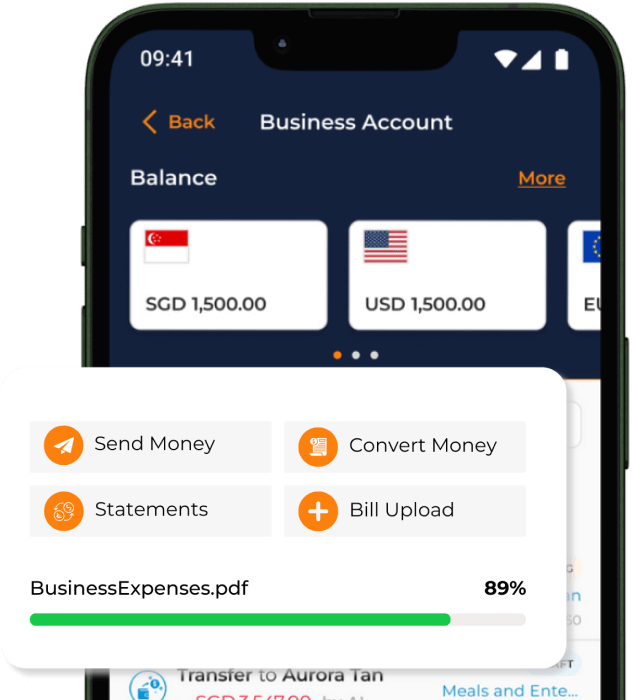

Free Financial Tools

Streamline your finances with our free app featuring a business account, expense management, and a corporate card.

XBRL Report Preparation

Enhance your financial reporting with our precise and efficient XBRL services.

Get Accounting Off Your Plate

Outsource your accounting to experienced professionals. Ensure accuracy and compliance with ease.

Personalised Solutions

Find solutions designed to address your specific challenges and goals.

Start-ups & SMEs

Mid-size Company

Wave Them Away With Outsourced Accounting Services In Singapore

Outsource your accounting to Grof and focus on growing your business.

Outsourcing accounting eliminates the time-consuming tasks of managing paperwork and spreadsheets, freeing up your schedule.

Our number wizards keep your books tidy and taxes right, giving you peace of mind, so you can focus on building your business. Sleep easy, we're on it.

By handing off accounting, you gain the time and headspace to focus on strategic business development and driving growth.

Insider's Edge - Outsource Accounting, No Regrets

Level up your understanding about accounting services in Singapore.

Accuracy & Compliance

IRAS Filing Deadlines:

- Corporate income tax Return (Form C-S/Form C-S (Lite)/Form C): Estimated Chargeable Income (ECI) within 3 months of financial year-end. Final tax return due by November of the following year.

- Individual Income Tax: Filing due April 15th of the following year.

- GST: Quarterly filing and payment deadlines.

Strategic Tax

Optimisation

In Singapore, strategic tax optimisation helps businesses maximise profits and stay competitive. Proactively leverage tax laws, deductions, and incentives – like the Start-up Tax Exemption (STE) or Partial Tax Exemption (PTE) – to minimise your tax burden. Partner with tax specialists to ensure compliance, optimise your position, and reinvest savings into your business growth.

Get the Right Package

Choose an accounting package that aligns with your budget and business needs.